EXHIBIT 99.7

Published on September 22, 2025

| EVALUATION SUMMARY BEDROCK PRODUCTION, LLC INTERESTS CERTAIN PROPERTIES IN OKLAHOMA AND TEXAS TOTAL PROVED RESERVES AS OF DECEMBER 31, 2024 SEC PRICE CASE CAWLEY, GILLESPIE & ASSOCIATES, INC. PETROLEUM CONSULTANTS TEXAS REGISTERED ENGINEERING FIRM F-693 W. TODD BROOKER, P.E. PRESIDENT THOMAS M. BARR SR. RESERVOIR ENGINEER |

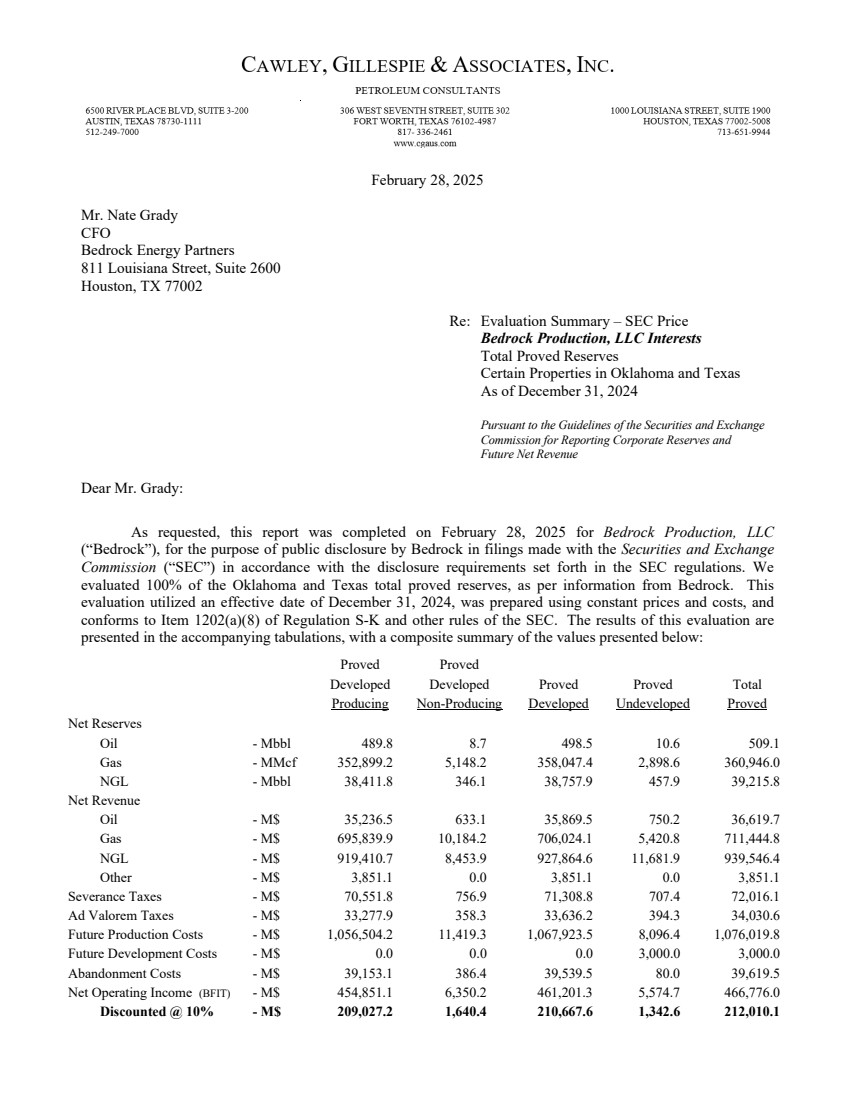

| February 28, 2025 Mr. Nate Grady CFO Bedrock Energy Partners 811 Louisiana Street, Suite 2600 Houston, TX 77002 Re: Evaluation Summary – SEC Price Bedrock Production, LLC Interests Total Proved Reserves Certain Properties in Oklahoma and Texas As of December 31, 2024 Pursuant to the Guidelines of the Securities and Exchange Commission for Reporting Corporate Reserves and Future Net Revenue Dear Mr. Grady: As requested, this report was completed on February 28, 2025 for Bedrock Production, LLC (“Bedrock”), for the purpose of public disclosure by Bedrock in filings made with the Securities and Exchange Commission (“SEC”) in accordance with the disclosure requirements set forth in the SEC regulations. We evaluated 100% of the Oklahoma and Texas total proved reserves, as per information from Bedrock. This evaluation utilized an effective date of December 31, 2024, was prepared using constant prices and costs, and conforms to Item 1202(a)(8) of Regulation S-K and other rules of the SEC. The results of this evaluation are presented in the accompanying tabulations, with a composite summary of the values presented below: Proved Proved Developed Developed Proved Proved Total Producing Non-Producing Developed Undeveloped Proved Net Reserves Oil - Mbbl 489.8 8.7 498.5 10.6 509.1 Gas - MMcf 352,899.2 5,148.2 358,047.4 2,898.6 360,946.0 NGL - Mbbl 38,411.8 346.1 38,757.9 457.9 39,215.8 Net Revenue Oil - M$ 35,236.5 633.1 35,869.5 750.2 36,619.7 Gas - M$ 695,839.9 10,184.2 706,024.1 5,420.8 711,444.8 NGL - M$ 919,410.7 8,453.9 927,864.6 11,681.9 939,546.4 Other - M$ 3,851.1 0.0 3,851.1 0.0 3,851.1 Severance Taxes - M$ 70,551.8 756.9 71,308.8 707.4 72,016.1 Ad Valorem Taxes - M$ 33,277.9 358.3 33,636.2 394.3 34,030.6 Future Production Costs - M$ 1,056,504.2 11,419.3 1,067,923.5 8,096.4 1,076,019.8 Future Development Costs - M$ 0.0 0.0 0.0 3,000.0 3,000.0 Abandonment Costs - M$ 39,153.1 386.4 39,539.5 80.0 39,619.5 Net Operating Income (BFIT) - M$ 454,851.1 6,350.2 461,201.3 5,574.7 466,776.0 Discounted @ 10% - M$ 209,027.2 1,640.4 210,667.6 1,342.6 212,010.1 |

| Bedrock Production, LLC Interests February 28, 2025 Page 2 Future revenue is prior to deducting state production taxes and ad valorem taxes. Future net cash flow (net operating income) is after deducting these taxes, future development costs, and operating expenses, but before consideration of federal income taxes. In accordance with SEC guidelines, the future net cash flow has been discounted at an annual rate of ten (10) percent to determine its present worth. The present worth is shown to indicate the effect of time on the value of money and should not be construed as being the fair market value of the properties by Cawley, Gillespie & Associates, Inc. (CG&A). The oil reserves include oil and condensate. Oil and natural gas liquid (NGL) volumes are expressed in barrels (42 U.S. gallons). Gas volumes are expressed in thousands of standard cubic feet (Mcf) at contract temperature and pressure base. Presentation This report is divided into a Summary section, consisting of Total Proved (“TP”) and Proved Developed (“PD”), followed by three (3) reserve category sections, Proved Developed Producing (“PDP”), Proved Developed Non-Producing (“PDNP”) and Proved Undeveloped (“PUD”). Within each category section are grand total Table I summaries. The Table I presents composite reserve estimates and economic forecasts for the particular reserve category. Following certain Table Is are Table II “oneline” summaries, sorted alphabetically by property ID and then lease name, that present estimates of ultimate recovery, gross and net reserves, ownership, revenue, expenses, investments, net income and discounted cash flow for the individual properties that make up the corresponding Table I. The data presented in each Table I is explained on page one (1) of the Appendix. For a more detailed explanation of the report layout, please refer to the Table of Contents following this letter. Hydrocarbon Pricing The base SEC oil and gas prices calculated for December 31, 2024 were $75.48/bbl and $2.130/MMBTU, respectively. As specified by the SEC, a company must use a 12-month average price, calculated as the unweighted arithmetic average of the first-day-of-the-month price for each month within the 12-month period prior to the end of the reporting period. The base oil price is based upon WTI Cushing spot prices (EIA) during 2024 and the base gas price is based upon Henry Hub spot prices (Platts Gas Daily) during 2024. Furthermore, NGL prices were adjusted on a summary level and averaged 33.3% of the proved net oil price on a composite basis. The base prices were adjusted for differentials on a contract basis, which may include local basis differentials, transportation, gas shrinkage, gas heating value (BTU content) and/or crude quality and gravity corrections. After these adjustments, the net realized prices for the SEC price case over the life of the proved properties were estimated to be $71.929 per barrel for oil, $1.971 per MCF for natural gas and $23.958 per barrel for NGL. All economic factors were held constant (not escalated) in accordance with SEC guidelines. Economic Parameters Ownership was accepted as furnished and has not been independently confirmed. Oil and gas price differentials, gas shrinkage, ad valorem taxes, oil and gas severance taxes, future production costs (lease operating expenses) and future development costs (capital investments) were calculated and prepared by Bedrock and reviewed by us at a summary level using historical lease operating statement data. All economic parameters, including lease operating expenses (LOE) and investments, were held constant (not escalated) throughout the life of these properties in accordance with SEC guidelines. LOE includes fixed and variable components. The fixed LOE costs represent all costs not tied to produced volumes and can be found as Operating Expense (column 22) in the attached tables. The variable costs consist of fees for water disposal, gas compression, processing and transportation, and other variable expenses. These costs can be found as Other Deductions (column 27) in the attached tables. This report also contains Other Revenue (column 16) which captures revenue received from Bedrock’s natural gas gathering system in the Barnett Shale basin. |

| Bedrock Production, LLC Interests February 28, 2025 Page 3 SEC Conformance and Regulations The reserve classifications and the economic considerations used herein conform to the criteria of the SEC as defined on pages three (3) and four (4) of the Appendix, except for the inclusion of the five (5) PDNP incremental wedge cases and 17 PUD locations that do not meet commerciality standards, as described below. The reserves and economics are predicated on regulatory agency classifications, rules, policies, laws, taxes, and royalties currently in effect except as noted herein. Bedrock’s operations may be subject to various levels of governmental controls and regulations. These controls and regulations may include matters relating to land tenure, drilling, production practices, environmental protection, marketing and pricing policies, royalties, various taxes and levies including income tax and are subject to change from time to time. Such changes in governmental regulations and policies may cause volumes of reserves actually recovered and amounts of income actually received to differ significantly from the estimated quantities. CG&A evaluated 21 PDNP cases representing workovers, of which 11 are standalone wells while ten (10) are incremental wedges for PDP wells. These workovers include tubing and casing repairs and swabbing. This evaluation also includes 19 PUD locations which represent horizontal well opportunities targeting the Barnett Shale reservoir in Texas. Five (5) PDNP incremental wedge cases and 17 PUD locations do not meet the commerciality standards but have remained categorized as such in this report as placeholders for future development. The drilling schedule was provided by Bedrock based upon their go forward plan and was accepted by CG&A as furnished. In our opinion, Bedrock has indicated they have every intent to complete this development plan as scheduled. Furthermore, Bedrock has demonstrated that they have the proper company staffing, financial backing and prior development success to ensure this development plan will be fully executed. Reserve Estimation Methods The methods employed in estimating reserves are described on page two (2) of the Appendix. Reserves assigned to each producing well (PDP) were based on a combination of forecasting methods including decline curve analysis (DCA), regional type curve analysis and analogy to offset production. Certain new producing properties with very little production history were forecast using a combination of production performance and analogy to similar production, both of which are considered to provide a relatively high degree of accuracy. Non-producing reserve estimates for developed and undeveloped properties were forecast using either production performance, volumetric or analogy methods, or a combination of each. These methods provide a relatively high degree of accuracy for predicting PDNP and PUD reserves due to the mature nature of their properties targeted for development and an abundance of subsurface control data. The assumptions, data, methods and procedures used herein are appropriate for the purpose served by this report. General Discussion The estimates and forecasts were based upon interpretations of data furnished by Bedrock and available from our files. To some extent information from public records has been used to check and/or supplement these data. The basic engineering and geological data were subject to third party reservations and qualifications. Nothing has come to our attention, however, that would cause us to believe that we are not justified in relying on such data. All estimates represent our best judgment based on the data available at the time of preparation. Reserves estimates will generally be revised as additional geologic or engineering data become available or as economic conditions change. Moreover, estimates of reserves may increase or decrease as a result of future operations, effects of regulation by governmental agencies or geopolitical or economic risks. As a result, the estimates of oil and gas reserves have an intrinsic uncertainty. The reserves included in this report are therefore estimates only and should not be construed as being exact quantities. They may or may not be actually recovered, and if recovered, the revenues therefrom, and the actual costs related thereto, could be more or less than the estimated amounts. An on-site field inspection of the properties has not been performed. The mechanical operation or condition of the wells and their related facilities have not been examined nor have the wells been tested by Cawley, Gillespie & Associates, Inc. Possible environmental liability related to the properties has not been |

| Bedrock Production, LLC Interests February 28, 2025 Page 4 investigated nor considered. The cost of plugging and the salvage value of equipment at abandonment have been considered in this evaluation as directed. Cawley, Gillespie & Associates, Inc. is a Texas Registered Engineering Firm (F-693), made up of independent registered professional engineers and geologists that have provided petroleum consulting services to the oil and gas industry for over 60 years. This evaluation was supervised by W. Todd Brooker, President at Cawley, Gillespie & Associates, Inc. and a State of Texas Licensed Professional Engineer (License #83462). We do not own an interest in the properties or Bedrock Production, LLC and are not employed on a contingent basis. We have used all methods and procedures that we consider necessary under the circumstances to prepare this report. Our work-papers and related data utilized in the preparation of these estimates are available in our office. Yours very truly, CAWLEY, GILLESPIE & ASSOCIATES, INC. TEXAS REGISTERED ENGINEERING FIRM F-693 W. Todd Brooker, P. E. President Thomas M. Barr Sr. Reservoir Engineer |

| CAWLEY, GILLESPIE & ASSOCIATES, INC. PETROLEUM CONSULTANTS 6500 RIVER PLACE BLVD, SUITE 3-200 306 WEST SEVENTH STREET, SUITE 302 1000 LOUISIANA STREET, SUITE 1900 AUSTIN, TEXAS 78730-1111 FORT WORTH, TEXAS 76102-4987 HOUSTON, TEXAS 77002-5008 512-249-7000 817- 336-2461 713-651-9944 www.cgaus.com Professional Qualifications of W. Todd Brooker, P.E. Primary Technical Person The evaluation summarized by this report was conducted by a proficient team of geologists and reservoir engineers who integrate geological, geophysical, engineering and economic data to produce high quality reserve estimates and economic forecasts. This report was supervised by Todd Brooker, President of Cawley, Gillespie & Associates, Inc. (CG&A). Prior to joining CG&A, Mr. Brooker worked in Gulf of Mexico drilling and production engineering at Chevron USA. Mr. Brooker has been an employee of CG&A since 1992 and became President in 2017. His responsibilities include reserve and economic evaluations, fair market valuations, expert reporting and testimony, field/reservoir studies, pipeline resource assessments, field development planning and acquisition/divestiture analysis. His reserve reports are routinely used for public company U.S. Securities and Exchange Commission (SEC) disclosures. His experience includes significant projects in both conventional and unconventional resources in every major U.S. producing basin and abroad, including oil and gas shale plays, coalbed methane fields, waterfloods and complex, faulted structures. Mr. Brooker graduated with honors from the University of Texas at Austin in 1989 with a Bachelor of Science degree in Petroleum Engineering. He is a registered Professional Engineer in the State of Texas (License #83462), a member of the Society of Petroleum Engineers (SPE) and serves on the board of directors for Society of Petroleum Evaluation Engineers (SPEE). Based on his educational background, professional training and more than 30 years of experience, Mr. Brooker and CG&A continue to deliver independent, professional, ethical and reliable engineering and geological services to the petroleum industry. CAWLEY, GILLESPIE & ASSOCIATES, INC. TEXAS REGISTERED ENGINEERING FIRM F-693 |