EXHIBIT 10.16

Published on August 28, 2024

Exhibit 10.16

Portions of this document have been redacted pursuant to Item 601(b)(10)(iv) of Regulation S-K because it is both not material and is the type that the registrant treats as private or confidential. Redacted portions are indicated with the notation “[***]”.

Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Notice (Employee)

BKV CORPORATION

TIME RESTRICTED STOCK UNIT AWARD AND PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD NOTICE

2024 EQUITY AND COMPENATION INCENTIVE PLAN

BKV Corporation, a Delaware corporation (the “Company”), pursuant to its 2024 Equity and Incentive Compensation Plan, as amended from time to time (the “Plan”), hereby grants to the Participant the number of Restricted Stock Units (as defined in the Plan) subject to service-based vesting requirements as set forth below (the “Time Restricted Stock Units” or “TRSUs”) and the number of Restricted Stock Units (as defined in the Plan) subject to performance-based vesting requirements as set forth below (the “Performance-based Restricted Stock Units” or “PRSUs”). The Time Restricted Stock Units and the Performance-based Restricted Stock Units are subject to all of the terms and conditions as set forth in this Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Notice (this “Award Notice”) and in the Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Agreement (the “Agreement”) and the Plan, both of which are attached hereto and incorporated herein in their entirety.

| Participant: | [ ] | |

| Date of Grant: | [ ] | |

| Number of Time Restricted Stock Units: | [ ] | |

| TRSU Vesting Schedule: | One-third of the TRSUs vest on each of the first three anniversaries of January 1, 2024 | |

| Number of Performance-based Restricted Stock Units at the Target Payout (as defined in Exhibit A attached to the Agreement the “Target Payout”): | [ ] | |

| PRSU Vesting Schedule: | As set forth in Exhibit A attached to the Agreement. | |

| Performance Period: | As set forth in Exhibit A attached to the Agreement. |

The undersigned Participant acknowledges that the Participant has received a copy of this Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Notice, the Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Agreement and the Plan. As an express condition to the grant of the Award hereunder, the Participant agrees to be bound by the terms of this Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Notice, the Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Agreement and the Plan. The undersigned Participant further acknowledges that as of the Date of Grant, this Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Notice, the Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Agreement, and the Plan set forth the entire understanding between the Participant and the Company regarding the Award and supersede all prior oral and written agreements on that subject with the exception of (i) Awards previously granted and delivered to the Participant by the Company, and (ii) any agreements referenced in this Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Notice. This Award Notice may be executed in one or more counterparts, each of which shall be deemed to be an original but all of which together will constitute one and the same agreement.

| BKV CORPORATION: | PARTICIPANT: | |||

| By: | ||||

| Name: | Date: | |||

| Title: | Address: | |||

Time Restricted Stock Unit Award and Performance-based Unit Award Agreement (Employee)

TIME RESTRICTED STOCK UNIT AWARD AND PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD AGREEMENT

UNDER THE

BKV CORPORATION 2024 EQUITY AND INCENTIVE COMPENATION PLAN

Pursuant to the Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Notice attached hereto (the “Award Notice”), and subject to the terms of this Time Restricted Stock Unit Award and Performance-based Restricted Stock Unit Award Agreement (this “Agreement”) and the BKV Corporation 2024 Equity and Incentive Compensation Plan (the “Plan”), BKV Corporation, a Delaware corporation (the “Company”), and the Participant agree as follows. Capitalized terms not otherwise defined in this Agreement or in the Award Notice will have the same meanings as set forth in the Plan.

| 1. | Award. |

| a. | Award of Time Restricted Stock Units. Subject to the terms and conditions set forth herein and in the Plan, the Company hereby grants to the Participant Time Restricted Stock Units, as set forth in the Award Notice, subject to adjustment as provided in the Plan, and each of which, if vested pursuant to this Agreement, will be settled in one (1) Common Share, at the time and subject to the terms, conditions and restrictions set forth in this Agreement and the Plan. Unless and until the Time Restricted Stock Units vest in accordance with this Agreement, Participant will have no right to receive any Common Shares or other payment in respect of the Time Restricted Stock Units. Prior to settlement of the Time Restricted Stock Units, the Time Restricted Stock Units and this Agreement represent an unsecured obligation of the Company, payable only from the general assets of the Company. |

| b. | Award of Performance-based Restricted Stock Units. Subject to the terms and conditions set forth herein and in the Plan, the Company hereby grants to the Participant Performance-based Restricted Stock Units, as set forth in the Award Notice, subject to adjustment as provided in the Plan, and each of which, if vested and earned pursuant to this Agreement, will be settled in one (1) Common Share, at the time and subject to the terms, conditions and restrictions set forth in this Agreement and the Plan. Unless and until the Performance-based Restricted Stock Units are earned and vest in accordance with this Agreement, Participant will have no right to receive any Common Shares or other payment in respect of the Performance-based Restricted Stock Units. Prior to settlement of the Performance-based Restricted Stock Units, the Performance-based Restricted Stock Units and this Agreement represent an unsecured obligation of the Company, payable only from the general assets of the Company. |

| 2. | Vesting. |

| a. | Time Restricted Stock Units. Except as otherwise provided in this Agreement or the Plan, the Time Restricted Stock Units will vest in the amounts and on the date(s) as indicated in the TRSU Vesting Schedule set forth in the Award Notice (each a “TRSU Vesting Date”), provided the Participant remains in the Service of the Company or a Subsidiary through the applicable TRSU Vesting Date. Except as otherwise provided in this Agreement or the Plan, or as otherwise determined by the Committee, any Time Restricted Stock Units that have not vested as of the date of the Participant’s termination of Service shall be forfeited and terminate. |

1

| b. | Performance-based Vesting; Determination of Amount of Performance-based Restricted Stock Units. Except as otherwise provided in this Agreement or the Plan, the Performance-based Restricted Stock Units will be earned and vested and the number of Common Shares payable in settlement of such earned and vested Performance-based Restricted Stock Units will be based on the level of achievement of the PRSU KPIs during the Performance Period as determined by the Board in good faith in accordance with Exhibit A attached to this Agreement, which determination shall be made as soon as practicable and, in any event, within 90 days following the end of the Performance Period, provided the Participant remains in the Service of the Company or a Subsidiary through the day following the last day of the Performance Period. Except as otherwise provided in this Agreement or the Plan, or as otherwise determined by the Committee, any Performance-based Restricted Stock Units that have not vested as of the date of the Participant’s termination of Service shall be forfeited and terminate. |

| c. | Death or Disability. |

| i. | Time Restricted Stock Units. Notwithstanding Section 2(a), if the Participant dies while employed by the Company or a Subsidiary or the Company terminates the Participant’s Service due to the Participant’s Disability, subject to the Participant’s (or the Participant’s legal representative’s, heir’s, legatee’s or distributee’s, as applicable) (i) timely execution of a general release of claims in a form satisfactory to the Company and (ii) if applicable, failure to revoke such execution or signature in accordance with the terms of such release, in each case, during the period to execute and revoke such release of claims (such period, the “Consideration Period”), the Time Restricted Stock Units shall vest. |

| ii. | Performance-based Restricted Stock Units. Notwithstanding Section 2(b), if the Participant dies while employed by the Company or a Subsidiary or the Company terminates the Participant’s Service due to the Participant’s Disability prior to the day following the last day of the Performance Period, then subject to the Participant’s (or the Participant’s legal representative’s, heir’s, legatee’s or distributee’s, as applicable) (i) timely execution of a general release of claims in a form satisfactory to the Company and (ii) if applicable, failure to revoke such execution or signature in accordance with the terms of such release during the Consideration Period, the Performance-based Restricted Stock Units shall vest at the Target Payout. |

2

| d. | Termination without Cause. |

| i. | Time Restricted Stock Units. If the Participant’s Service with the Company or a Subsidiary is terminated by the Company other than for Cause (other than by reason of death or Disability) prior to the TRSU Vesting Date, the Time Restricted Stock Units shall be forfeited and terminate. |

| ii. | Performance-based Restricted Stock Units. Notwithstanding Section 2(b), and subject to Section 5 of this Agreement, if the Participant’s Service with the Company or a Subsidiary is terminated by the Company other than for Cause and other than by reason of death or Disability prior to the day following the last day of the Performance Period, subject to the Participant’s (i) timely execution of a general release of claims in a form satisfactory to the Company and (ii) if applicable, failure to revoke such execution or signature in accordance with the terms of such release during the Consideration Period, (1) if such termination of Service occurs in the final six (6) months of the Performance Period, the Performance-based Restricted Stock Units will remain outstanding and will thereafter vest in accordance with Section 2(b) as if the Participant had remained in the Service of the Company or a Subsidiary from the Date of Grant through the day following the last day of the Performance Period, or (2) if such termination of Service occurs prior to the final six (6) months of the Performance Period, the Performance-based Restricted Stock Units will vest at Target Payout. In either case of (1) or (2) above, the number of Performance-based Restricted Stock Units in which the Participant so vests shall be prorated based on a fraction, the numerator of which is the number of calendar days that have elapsed from the first day of the Performance Period through the date of the Participant’s termination, and the denominator of which is the number of calendar days from the first day of the Performance Period through the last day of the Performance Period. |

| e. | Termination for Cause. For the avoidance of doubt, if the Participant’s employment is terminated for Cause, any Time Restricted Stock Units or Performance-based Restricted Stock Units that have not vested as of the date of the Participant’s termination of Service by the Company for Cause shall be forfeited and terminate automatically. This Section 2(e) applies regardless of whether such termination for Cause occurs prior to or after any Change in Control. |

| f. | Forfeiture Events. If, prior to a Change in Control, the Participant is determined by the Committee, acting in its sole discretion, to have taken any action that would constitute Cause or an Adverse Action, irrespective of whether such action or the Committee’s determination occurs before or after termination of the Participant’s Service and irrespective of whether or not the Participant was terminated for Cause, (i) all rights of the Participant under this Agreement and the Plan will terminate and be forfeited without notice of any kind; and (ii) the Committee, in its sole discretion, may require the Participant to surrender and return to the Company all or any Common Shares received in connection with the vesting of the Time Restricted Stock Units or Performance-based Restricted Stock Units, or to disgorge all or any profits or any other economic value (however defined by the Committee) made or realized by the Participant on the sale of such Common Shares, during the period beginning one year prior to the Participant’s termination of Service. This Section 2(f) applies only to any such determinations made prior to a Change in Control and shall not apply following a Change in Control. |

3

| 3. | Settlement; Issuance of Common Stock. |

| a. | Time Restricted Stock Units. |

| i. | Timing and Manner of Settlement. As soon as practicable and, in any event, no later than 15 days, following the vesting of Time Restricted Stock Units, such vested Time Restricted Stock Units will be converted to Common Shares which the Company will issue and deliver to the Participant (either by delivering one or more certificates for such shares or by entering such shares in book entry form in the name of the Participant or depositing such shares for the Participant’s benefit with any broker with which the Participant has an account relationship or the Company has engaged to provide such services under the Plan) and record such shares on the records of the Company, except to the extent that Common Shares are withheld to pay tax withholding obligations pursuant to Section 3(c) of this Agreement. For Time Restricted Stock Units that vest pursuant to Section 2(c), if the Consideration Period spans two calendar years, then notwithstanding this Section 3(a), the Time Restricted Stock Units shall be settled in Common Shares in the second calendar year. |

| b. | Performance-based Restricted Stock Units. |

| i. | Timing and Manner of Settlement. As soon as practicable and, in any event, no later than 15 days following determination by the Board of the level of achievement of the PRSU KPIs of the Performance-based Restricted Stock Units, the number of Performance-based Restricted Stock Units determined by the Committee to have been earned will be converted to Common Shares which the Company will issue and deliver to the Participant (either by delivering one or more certificates for such shares or by entering such shares in book entry form in the name of the Participant or depositing such shares for the Participant’s benefit with any broker with which the Participant has an account relationship or the Company has engaged to provide such services under the Plan), except to the extent that Common Shares are withheld to pay tax withholding obligations pursuant to Section 3(c) of this Agreement. For Performance-based Restricted Stock Units that vest pursuant to Section 2(c), if the Consideration Period spans two calendar years, then notwithstanding this Section 3(b), the Performance-based Restricted Stock Units shall be settled in the second calendar year. |

4

| c. | Withholding Taxes. Whenever any Time Restricted Stock Units vest or Performance-based Restricted Stock Units granted under the terms of this Agreement are earned and vest and Common Shares are issued in settlement thereof, the Participant is responsible to provide to the Company when due, the minimum amount necessary for the Company to satisfy all of the federal, state and local withholding (including FICA) tax requirements relating to such taxable event. The Board may, in its sole discretion and upon terms and conditions established by the Board, permit or require the Participant to satisfy these minimum withholding tax obligations in connection with the settlement of the vested Time Restricted Stock Units and/or earned and vested Performance-based Restricted Stock Units by a broker-assisted sale and/or the Company withholding Common Shares issuable upon settlement of the Time Restricted Stock Units or Performance-based Restricted Stock Units and/or take other actions specified in the Plan. When either selling Common Shares in a broker-assisted sale or withholding Common Shares for taxes is effected under this Agreement and the Plan, the broker shall be directed to sell (in the case of a broker-assisted sale) or the Company may withhold (in the case of net-settlement), in each case, Common Shares with a fair market value equal to the minimum amount it reasonably determines is necessary to satisfy any tax withholding obligation in the Participant’s tax jurisdiction. |

| 4. | Rights of Participant; Transferability. |

| a. | No Right to Continued Service or Future Awards. Nothing in the Plan or in this Agreement confers upon the Participant any right to continue in the Service of the Company or any Subsidiary or interferes with or limits in any way the right of the Company or any Subsidiary to terminate the Service of the Participant at any time, with or without notice and with or without Cause. The grant of Time Restricted Stock Units and Performance-based Restricted Stock Units under this Agreement to the Participant is a voluntary, discretionary award being made on a one-time basis and it does not constitute a commitment to make any future awards. |

| b. | Rights as a Shareholder. The Participant shall have no rights as a Shareholder with respect to any Common Shares subject to the Time Restricted Stock Units or Performance-based Restricted Stock Units prior to the date as of which the Participant is actually recorded as the holder of such Common Shares upon the share records of the Company pursuant to Section 3 above. |

5

| d. | Non-Transferability. Except as otherwise expressly permitted by the Plan, no Time Restricted Stock Units or Performance-based Restricted Stock Units may be assigned or transferred, or subjected to any lien or encumbrance, during the lifetime of the Participant, either voluntarily or involuntarily, directly or indirectly, by operation of law or otherwise. Except to the extent expressly permitted by the Plan, any purported sale, pledge, lien, assignment, transfer, attachment or encumbrance of such Restricted Stock Units shall be null, void and unenforceable against the Company. |

| 5. | Change in Control. Notwithstanding anything to the contrary in this Agreement, in the event of a Change in Control, if the Time Restricted Stock Units or Performance-based Restricted Stock Units do not continue or are not assumed, substituted or replaced with an award with respect to cash or shares of the acquiror or surviving entity in such Change in Control, in each case, with substantially equivalent terms and value as the Time Restricted Stock Units or Performance-based Restricted Stock Units, as applicable, any unvested Time Restricted Stock Units shall vest and any Performance-based Restricted Stock Units shall vest immediately prior to the Change in Control at the greater of the Target Payout or, if determinable, the level of achievement of the PRSU KPIs during the Performance Period through the latest practicable date prior to the Change in Control, as determined by the Board. In the event of a Change in Control in which the Time Restricted Stock Units and Performance-based Restricted Stock Units continue or are assumed, substituted or replaced with an award with respect to cash or shares of the acquiror or surviving entity in such Change in Control: |

| a. | the Time Restricted Stock Units, as so continued, assumed, substituted or replaced, shall remain subject to the terms and conditions of this Agreement; provided, that, notwithstanding Section 2(a), Section 2(c) or Section 2(d), if the Participant’s Service with the Company or a Subsidiary is terminated pursuant to a Qualifying Termination within the 24-month period beginning on the Change in Control and ending at the end of the second anniversary of the Change in Control, the Time Restricted Stock Units, as so continued, assumed, substituted or replaced, will vest, and |

| b. | the PRSU KPIs for any Performance-based Restricted Stock Units shall be deemed to have been met at the greater of the Target Payout or, if determinable, the level of achievement of the PRSU KPIs during the Performance Period through the latest practicable date prior to the Change in Control, as determined by the Board in good faith, and the Performance-based Restricted Stock Units, as so scored and continued, assumed, substituted or replaced, shall otherwise remain subject to the terms and conditions of this Agreement, including the requirement that the Participant remain in the Service of the Company or a Subsidiary through the day following the last day of the Performance Period; provided that, notwithstanding Section 2(b), Section 2(c) or Section 2(d), if the Participant’s Service with the Company or a Subsidiary is terminated prior to the day following the last day of the Performance Period pursuant to a Qualifying Termination within the 24-month period beginning on the Change in Control and ending at the end of the second anniversary of the Change in Control, the Performance-based Restricted Stock Units, as so scored and continued, assumed, substituted or replaced, will vest. |

6

| 6. | Securities Laws Restrictions. Notwithstanding any other provision of the Plan or this Agreement, the Company will not be required to issue any Common Shares pursuant to the vesting of the Time Restricted Stock Units or Performance-based Restricted Stock Units if such issuance would constitute a violation of any applicable law or regulation or the requirements of any securities exchange or market system upon which the Common Shares may then be listed. In addition, Common Shares will not be issued hereunder unless (a) there is in effect with respect to such Common Shares a registration statement under the Securities Act of 1933, as amended (the “Securities Act”), or (b) in the opinion of legal counsel to the Company, the Common Shares are permitted to be issued in accordance with the terms of an applicable exemption from the registration requirements of the Securities Act. The inability of the Company to obtain from any regulatory body having jurisdiction the authority, if any, deemed by the Company’s legal counsel to be necessary for the lawful issuance and sale of any Common Shares hereunder will relieve the Company of any liability in respect of the failure to issue such Common Shares as to which such requisite authority has not been obtained. As a condition to the issuance of any Common Shares hereunder, the Company may require the Participant to satisfy any requirements that may be necessary or appropriate to evidence compliance with any applicable law or regulation and to make any representation or warranty with respect to such compliance as may be requested by the Company. |

| 7. | Certain Definitions. |

| a. | “Adverse Action” means any Participant, during or within one year after the termination of Service, (a) being employed or retained by or rendering services to any organization that, directly or indirectly, competes with or becomes competitive with the Company or any Subsidiary, or otherwise violating any non-compete or non-solicitation agreement with the Company or any Subsidiary as determined by the Committee, (b) violating any confidentiality agreement or agreement governing the ownership or assignment of intellectual property rights of the Company or any Subsidiary as determined by the Committee, or (c) engaging in any other conduct or act during the Participant’s Service that is determined by the Committee to be materially injurious, detrimental or prejudicial to any interest of the Company or any Subsidiary. |

| b. | “Cause” shall have the meaning ascribed thereto in any employment or other agreement or policy applicable to the Participant’s employment with the Company or any of its Subsidiaries as may be in effect, or if no such agreement or policy exists, shall mean (i) the Participant’s commission of a felony or any crime of moral turpitude, in each case, relating to the Company or any of its Subsidiaries or that is materially injurious to the Company or any of its Subsidiaries’ reputation; (ii) commission of an act of dishonesty, fraud, misrepresentation, embezzlement, breach of fiduciary duty or deliberate injury or attempted injury, in each case relating to the Company or any of its Subsidiaries; (iii) the Participant’s repeated failure to perform the Participant’s duties in accordance with the Participant’s job description, employment agreement or service contract with the Company or any of its Subsidiaries, or the Participant’s material or repeated insubordination; (iv) a material or repeated breach by the Participant of any material provision of this Agreement or any material provision of any other agreement between the Participant and the Company or any of its Subsidiaries; or (v) the Participant’s material or repeated failure to comply with or the Participant’s material breach of the established work rules or internal policies of the Company or any of its Subsidiaries. In each case, the Committee has the sole discretion to determine in its reasonable judgment whether Cause exists. |

7

| c. | “Disability” shall have the meaning ascribed thereto in any employment or other agreement or policy applicable to the Participant’s Service with the Company or any of its Subsidiaries as may be in effect, or if no such agreement or policy exists, shall mean the Participant’s inability due to physical or mental incapacity, to perform the essential functions of the Participant’s job, for one hundred eighty (180) days out of any three hundred sixty-five (365) day period or one hundred twenty consecutive days. |

| d. | “Good Reason” shall have the meaning ascribed thereto in any employment or other agreement or policy applicable to the Participants Service with the Company or any of its Subsidiaries as may be in effect, or if no such agreement or policy exists, shall mean (i) a reduction in the Participant’s base salary or target bonus; (ii) a material breach by the Company of any material provision of this Agreement; (iii) a material, adverse change in the Participant’s authority, duties or responsibilities (other than temporarily while the Participant is physically or mentally incapacitated); or (iv) a relocation of the Participant’s principal place of employment by more than 50 miles. Notwithstanding the foregoing, the Participant shall not be considered to have terminated the Participant’s Service for Good Reason unless, within sixty (60) days following the occurrence of an event described in clause (i), (ii), (iii) or (iv) above, the Participant gives the Company written notice of the existence of an such event, the Company does not remedy such event within sixty (60) days of receiving such notice and the Participant terminates the Participant’s Service within thirty (30) days of the end of the Company’s cure period. |

| e. | “Qualifying Termination” shall mean a termination by the Company other than for Cause (other than by reason of death or Disability) or a termination by the Participant for Good Reason. |

| f. | “Service” means a Participant’s employment with the Company or any Subsidiary, whether in the capacity of an employee, Director or consultant, agent, advisor or independent contractor who renders services to the Company or a Subsidiary (and which services are not in connection with the offer and sale of the Company’s securities in a capital raising transaction and do not directly or indirectly promote or maintain a market for the Company’s securities. A change in the capacity in which the Participant renders service to the Company or a Subsidiary as an employee, Director or consultant, agent, advisor or independent contractor, shall be treated as a termination of the Participant’s Service, unless the Committee otherwise determines in its sole discretion, except that continuous Service shall not be considered interrupted in the case of transfers between locations of the Company and its Subsidiaries. A Participant’s Service will be deemed to have terminated either upon an actual termination of Service or upon the Subsidiary for which the Participant performs Service ceasing to be a Subsidiary of the Company (unless the Participant continues to be employed by the Company or another Subsidiary). |

8

| 8. | Miscellaneous. |

| a. | Relation to the Plan. This Agreement is subject to the terms of, the Plan, the terms of which are incorporated by reference in this Agreement in their entirety. In the event of any inconsistency between the provisions of this Agreement and the Plan, the terms of the Plan will prevail. |

| b. | Section 409A. The Time Restricted Stock Units and Performance-based Restricted Stock Units are intended to be exempt from the provisions of Section 409A of the Code or, if not so exempt, to comply with Section 409A of the Code and, wherever possible, this Agreement and the Plan shall be construed and administered to the fullest extent possible to reflect such intent. To the extent that any payment or benefit hereunder constitutes non-exempt “nonqualified deferred compensation” for purposes of Section 409A of the Code, and such payment or benefit would otherwise be payable or distributable hereunder by reason of the Participant’s termination of Service, all references to the Participant’s termination of Service shall be construed to mean a “separation from service” as defined in Section 409A of the Code (a “Section 409A Separation from Service”), and the Participant shall not be considered to have a termination of Service unless such termination constitutes a Section 409A Separation from Service. If, at the time of a Participant’s Section 409A Separation from Service, (i) the Participant will be a specified employee (within the meaning of Section 409A of the Code and using the identification methodology selected by the Company from time to time) and (ii) the Company makes a good faith determination that an amount payable hereunder constitutes deferred compensation (within the meaning of Section 409A of the Code) the payment of which is required to be delayed pursuant to the six-month delay rule set forth in Section 409A of the Code in order to avoid taxes or penalties under Section 409A of the Code, then the Company will not pay such amount on the otherwise scheduled payment date but will instead pay it, without interest, on the tenth business day of the seventh month after such separation from service. In any case, a Participant will be solely responsible and liable for the satisfaction of all taxes and penalties that may be imposed on a Participant or for a Participant’s account in connection with the Plan and this Agreement (including any taxes and penalties under Section 409A of the Code), and neither the Company nor any of its affiliates will have any obligation to indemnify or otherwise hold a Participant harmless from any or all of such taxes or penalties. |

9

| c. | Successors and Assigns. This Agreement will be binding upon and inure to the benefit of the successors and permitted assigns of the Company. Subject to the restrictions on transfer set forth herein and in the Plan, this Agreement will be binding upon the Participant and the Participant’s beneficiaries, executors and administrators. |

| d. | Governing Law and Venue. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware, without regard to conflicts of laws provisions thereof. Any legal proceeding related to this Agreement will be brought in an appropriate Delaware court, and the parties to this Agreement consent to the exclusive jurisdiction of the court for this purpose. |

| e. | Entire Agreement. This Agreement, the Award Notice and the Plan set forth the entire agreement and understanding of the parties to this Agreement with respect to the award of the Time Restricted Stock Units and Performance-based Restricted Stock Units and supersedes all prior agreements, arrangements, plans and understandings relating to the award of the Time Restricted Stock Units and Performance-based Restricted Stock Units and administration of the Plan. |

| f. | Amendment and Waiver. The Committee may, in its sole discretion, amend this Agreement from time to time in any manner that is not inconsistent with the Plan; provided, however, that (a) no amendment shall materially impair the rights of the Participant under this Agreement without the Participant’s consent, and (b) the Participant’s consent shall not be required to an amendment that is deemed necessary by the Company to ensure compliance with Section 409A of the Code. |

| g. | Construction; Severability. If a court of competent jurisdiction determines that any provision of this Agreement is invalid or unenforceable, then the invalidity or unenforceability of such provision shall not affect the validity or enforceability of any other provision of this Agreement and all other provisions shall remain in full force and effect. |

10

EXHIBIT A

PRSU KPIs

The Performance-based Restricted Stock Units may be earned based upon the achievement of the following PRSU KPIs over the TSR Performance Period or ROACE Performance Period, as applicable, as described below and shall be subject to the determination of the Board, in accordance with this Exhibit A.

| PRSU KPI | Minimum | Target | Maximum | Weighting |

| Annualized Total Shareholder Return | [***] | [***] | [***] | 30% |

| Relative Annualized Total Shareholder Return | [***] | [***] | [***] | 30% |

| Average Annual Return on Average Capital Employed (ROACE) | [***] | [***] | [***] | 40% |

| Payout Percentage | 0% | 100% (the “Target Payout”) | 200% |

If a particular PRSU KPI is earned at an amount that exceeds the Minimum and that is at a point between two adjacent performance levels (that is, between the Minimum and Target or between Target and Maximum), the level at which such PRSU KPI shall be earned and the number of PRSUs earned for such PRSU KPI shall be determined by straight line interpolation between such points. For the avoidance of doubt, no Performance-based Restricted Stock Units will be earned for a particular PRSU KPI that is not determined to have been met at a level at least equal to Minimum.

All determinations as to the achievement of the PRSU KPIs and the amount of Performance-based Restricted Stock Units that have been earned will be made by the Board in good faith in its sole discretion and such determinations shall be final and binding. The Board may, in its sole discretion and in good faith, make equitable adjustments to the amount of Performance-based Restricted Units that have been earned in the event of, and to take into consideration, unanticipated, significant and non-recurring circumstances or factors that occurred during the applicable performance period that the Board, acting in good faith, considers to be appropriate at such time and any such determination of the Board shall be final and binding.

11

Total Shareholder Return

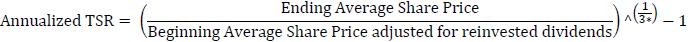

The portion of the Performance-based Restricted Stock Units subject to the Annualized Total Shareholder Return PRSU KPI may be earned based upon the achievement of the annualized TSR of the Company from January 1, 2024 and ending on the day on which the ROACE Performance Period (as defined below) ends (such period, the “TSR Performance Period”). Annualized TSR shall be determined based on the following formula:

Ending Average Share Price means the average of the Company’s closing stock prices of the last 20 trading days of the TSR Performance Period (including the last day of the TSR Performance Period); provided, that, if a dividend has an ex-dividend date during this 20-day averaging period, Adjusted Close Prices (as described below) will be used. If there is no regular public trading market for the Common Shares, the Ending Average Share Price shall be determined in accordance with the last sentence of the definition of Market Value per Share set forth in the Plan.

Beginning Average Share Price means $28.25 for purposes of determining Annualized TSR of the Company and, for purposes of determining the Annualized TSR of members of the Benchmark Group for the Relative Annualized Total Shareholder Return PRSU KPI, shall equal the average of the “Adjusted Close Price” or its equivalent (which assumes reinvested dividends throughout the performance period) as per FactSet (or its successor) for the company’s common stock for the first 20 trading days of the TSR Performance Period (including the first day of the TSR Performance Period). For clarity, FactSet currently utilizes the term “Total Return (Gross)” in place of “Adjusted Close Price.”

Relative Total Shareholder Return

The portion of the Performance-based Restricted Stock Units subject to the Relative Annualized Total Shareholder Return PRSU KPI may be earned based upon the achievement of the annualized TSR of the Company over the TSR Performance Period relative to the annualized TSR of the Benchmark Group over the TSR Performance Period.

| 1. | Benchmark Group. |

| a. | The Benchmark Group. The Benchmark Group shall include the companies in the Oil & Gas Exploration & Production sub-industry of the S&P Oil & Gas Exploration & Production Select Industry (Bloomberg Ticker: SPSIOP), whereby the Oil & Gas Exploration & Production sub-industry classification utilizes the GICS (Global Industry Classification Standard). |

| b. | Effect of Changes to Benchmark Group. |

| i. | The Benchmark Group utilized for percentile ranking purposes will include only companies that are included in the Benchmark Group on the IPO Effective Date. |

| ii. | If a company in the Benchmark Group is acquired and ceases to have its primary common equity security listed or traded prior to the end of the TSR Performance Period, such company will be omitted from the ranking of the Annualized TSR of companies in the Benchmark Group. |

| iii. | If a company in the Benchmark Group is forced to delist from the securities exchange upon which it was traded due to low stock price or other reasons or files for bankruptcy, such company shall be included in the ranking of the Annualized TSR of companies in the Benchmark Group but will be ranked last. |

| 2. | Ranking Benchmark Group for Purposes of Percentile Determination. The results of the Annualized TSR for each of the companies in the Benchmark Group (for the avoidance of doubt, excluding the Company) shall be ranked from highest to lowest Annualized TSR (rounded, if necessary, to one-tenth of a percentage point by application of regular rounding) and the Company’s Annualized TSR shall be compared to such ranking to determine the Company’s relative TSR percentile ranking. |

12

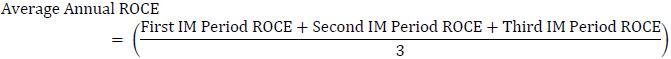

Average Annual Return on Average Capital Employed

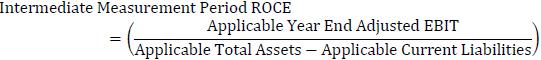

The portion of the Performance-based Restricted Stock Units subject to the Return on Average Capital Employed (“ROACE”) PRSU KPI may be earned based upon the achievement of the average annual return on capital (“Average Annual ROACE”) of the Company for each Intermediate Measurement Period during the ROACE Performance Period (as defined below).

The ROACE Performance Period shall begin on the first day of the First Intermediate Measurement Period (as defined below) and end on the last day of the Third Intermediate Measurement Period (as defined below).

An Intermediate Measurement Period means each of:

| · | The First Intermediate Measurement Period (or the “First IM Period”): The period beginning on the first day of the calendar year in which the IPO Effective Date occurs and ending on the last day of such calendar year; |

| · | The Second Intermediate Measurement Period (or the “Second IM Period”): The period beginning on the first day of the calendar year immediately following the last day of the First IM Period and ending on the last day of such calendar year; and |

| · | The Third Intermediate Measurement Period (or the “Third IM Period”): The period beginning on the first day of the calendar year immediately following the last day of the Second IM Period and ending on the last day of such calendar year. |

Applicable Year End Adjusted EBIT means Adjusted EBITDAX as defined in the Company’s 10-K that includes the applicable Intermediate Measurement Period (or, if no 10-K, as such term was defined in the most recently filed 10-K or 10-Q), less depreciation, depletion, amortization and accretion, less exploration expense, in each case, starting from the first day of the applicable Intermediate Measurement Period and ending on the last day of the applicable Intermediate Measurement Period.

Total Assets shall mean the Company’s total assets, excluding unrealized derivative assets, if any, and contingent consideration assets, if any, as each is set forth in the Company’s 10-K or 10-Q that includes the applicable measurement date (or, if no 10-K or 10-Q is on file for such period, as such term was defined in the most recently filed 10-K or 10-Q).

Applicable Total Assets shall mean, for each Intermediate Measurement Period, (1) the sum of the Total Assets as of the last day of the quarter immediately preceding the first day of the applicable Intermediate Measurement Period plus the Total Assets as of the last day of each of the first four quarters of the applicable Intermediate Measurement Period, divided by (2) five, which for the avoidance of doubt, uses five balance sheet positions to calculate the average for Total Assets.

Current Liabilities shall mean the Company’s current liabilities, excluding unrealized current derivative liabilities, if any, and current contingent consideration liabilities, if any, as each is set forth in the Company’s 10-K or 10-Q that includes the applicable measurement date (or, if no 10-K or 10-Q is on file for such period, as such term was defined in the most recently filed 10-K or 10-Q).

13

Applicable Current Liabilities shall mean, for each Intermediate Measurement Period, (1) the sum of the Current Liabilities as of the last day of the quarter immediately preceding the first day of the applicable Intermediate Measurement Period plus the Current Liabilities as of the last day of each of the first four quarters of the applicable Intermediate Measurement Period, divided by (2) five, which for the avoidance of doubt, uses five balance sheet positions to calculate the average for Current Liabilities.

14